Do Eurobonds save the Eurozone? What are the advantages and disadvantages for the EU? What has politics missed in the last years and how can the crisis be overcome? Spanish finance expert Fernando Primo de Rivera Garcia-Lomas, economist, lawyer, investor, former CEO und Chief Investment Officer at Armada Capital, and member of United Europe, has written a highly regarded piece in the Spanish newspaper “El Confidencial” which we are providing in English translation:

Sun and shadow in the future of Europe these weeks. On the one hand, the list of commissioners presented by Ursula von der Leyen, head of the Commission, confirms that Europe begins to interpret itself as a “geopolitical” issue in the face of Trump’s bullying, China, Russia, and the impending realities of the 21st century. On the other, the ECB action and message in the face of a harsh economic downturn, reflect the utmost impotence of monetary policy alone to manage the economy and evoke a real “swan song” for our financial and banking system.

When in the spring-summer of 2020 the Conference on the “Future of Europe” convened by von der Leyen, this new and vindictive Commission, and this European Parliament, in which the pro-European anti-populist proposal has been rescued from bipartisanship by liberals and greens, they are destined to give an account of the existential crisis veiled by the ECB and the chaotic government architecture that presides over it.

A current state of the Union in which any reformist impulse of the last seven years on any of its fronts is overwhelmed by the perennial and systematic rejection of creditors (Germany, Holland, Finland, etc.) to the mutualisation of risk (“risk sharing”) – a true religious crusade for obviating achievements in the management of the euro crisis, preserving a national-intergovernmental approach, bordering on populism, and building on what has been achieved. Perhaps then a spirit of transparency and a simply coherent political will conjure up the only possible rational solution that is cathartic and that for years has been an unmentionable taboo – Merkel proclaimed – the Eurobond.

Little by little the stars are aligning: The expeditiousness with which Italy has dismissed this summer Salvini (“operation Ursula” …), the return of Macron after the “yellow vests” and the relative strength of the French economy , or the recent opening of German finance minister Olaf Scholz (SPD) to Keynesian fiscal positions. We will have the real starting signal for this political impulse when this Christmas the Great Coalition in Germany might break down by an SPD at historical lows. Blurred by Merkel for years, the seduction of the party by a change of axis to a more federalist approach – the unexplored route in 2016 elections – will be compelling. There it may perhaps be re-founded, giving more space to solidarity, convergence and cohesion – principles to which it is by definition more akin. The reformulation of the Stability and Growth Pact (SGP of March 2010) in a Eurobond – the normative framework instrument for new discipline – is the most predictable political synthesis of this new Commission, this new Parliament and the probable overturn in German politics. The Eurobond is the instrument that consummates the transit in EU governance to more federal levels, solves the unsustainable macroeconomic management chaos and refloats the whole financial system. In foreign policy, the Eurobond makes the euro a real reserve currency with fiscal capacity, projects it as a symbol of European sovereignty and makes it an instrument of geopolitics. The critical issue of the Europa Conference will not be if Eurobond yes or no, but simply when and how.

ECB’s white flag, at its limit

The other week the ECB has come with a poor diagnose of inflation and growth – both just below 1%. The package of measures that plunges even more into negative rates with asset purchases (QE), seal the convalescence of the banking system, unlimited. The most revealing thing, both in terms of gestural language and the forcefulness of Draghi’s message, has been the covert complaint of being truly at the limit of bearing the full weight of macroeconomic management without the help of governments.

Certainly at this point – with the rates at 0% and the cycle down – it is very likely that the negative side effects of this package far outweigh the positive ones. How to push a string … The drop in rates and the injection of liquidity via purchases, does not reach the real economy because the real margin of manoeuvre for the banking system with medium-sized companies, at this level of rates, is non-existent.

Moreover, the package is contractive in aggregate demand: by having to save more to guarantee future income, at these low levels of rates, consumption is badly drained. Book liquidity trap: “japanization” in progress.

In Germany they pull the hair because the savings are not remunerated and perhaps soon even charged for. But truth is, you cannot blow and sip at the same time. After restricting domestic demand in the eurozone through deleveraging (SPG of March 2010) and internal devaluations in the periphery, without having a coordinated and powerful European fiscal mechanism – and now also suffering the whims of the Trump commercial wars – the possibility of reflating the economy and not flirting with deflation, are void. The feeling that remains in the ECB is of absolute helplessness and impotence.

Who would have thought that … Germany itself exposing the ECB, the only true European institution inspired by the rigour of the Bundesbank, to a total distortion of its mission as guarantor of the fiduciary principle and the stability of the financial system. And this by avoiding at all costs a holistic and systemic reading of the euro crisis. Having succumbed to the easy, electoral – credible but false – narrative of the “moral hazard” of transfers in a hypothetical fiscal union that would complete the monetary union, Merkel has rushed tacticism. If Jens Weidmann, president of the Bundesbank, a member of the ECB, were consistent and not politically conditioned, he should be reversing that narrative. The ECB at stake.

One of the axiomatic postulates of modern physics – eminently German (¡!) – says that any measurement is useless if it does not involve an estimation of the error incurred in making it. The mistake that has been made in nurturing this electoral narrative is of historical proportions, and a spur to populism in the North. The limitations of the imperfect diagnosis at the beginning of the euro crisis – confusing the symptoms (sovereign debt crisis) by causes (bank debt crisis and current account), and a prescription in its pragmatic moment – debt containment and internal devaluation, but interim and insufficient, were elevated to a ‘national mantra’ by that easy and irresponsible electoral narrative. A typical psychological bias is to interpret the world as best suits.

This “moral hazard” – or danger of subsidizing the inefficient, implicit in the expression “union of transfers” with which the fiscal union is contemptuously connoted (giving acknowledgement of receipt to the AfD, which resurfaced precisely after the second rescue to Greece in 2015) – is refuted by a more immanent truth: Germany is the great structural beneficiary of the euro. As a result of the “transfer in competitiveness” from south to north, its economy has now gone from exporting 18% of its pre-euro GDP to 50% today – almost triple weigh. Never in economic history a country has presented structural current account surpluses of 7-8% without suffering a massive appreciation of its currency that acts as an automatic stabilizer – something that the euro itself prevents. As a result, this annual surplus of aprox. euro 300 bn per year “balances” out unemployment rates amongst peripheral youth of over 30%. A half-truth has poisoned reasonable dialogue between creditors and camouflages reality.

In the end, an exclusive and only moral interpretation of the crisis against another structural and systemic, has its very roots in radical, quasi-religious, nationalistic motives, unappropriated of the XXI. century. The identity prejudices in 500 years of wars of religion – true civil wars in Europe – seem to collect ominously their toll. In Montaigne’s words: “Nothing is believed more firmly than what is less known.”

It is deeply revealing that Anglo-Saxon critics of the euro project take such a different range of nature. The most corrosive and obsessive – “picking German pockets” – populists in earnest, are based on that exclusively moral and nationalistic interpretation at all costs, including Europe´s future. Needless to say, these are born from the segments most prone to Brexit – divide and conquer – “Britannia rules the waves”. On the other side, the most systemic and structural – the most scientific, without dividing moral prejudices at root – come from the US capital markets. In earnest, a real invitation extended to Germany to come out of its parochialism.

New commission: The tower of Babel and the path to catharsis

The reluctance of creditors to any measure that involves risk sharing has fatally tainted the entire reformist agenda. The drift that has taken this “integrated management” of the euro is, at this point now, simply anarchic. It doesn´t deserve other adjective and it risks converting Germany´s instinct for order and discipline into a fading myth. There is no other underlying motto in this entrenched political standing than avoiding face the sheer reality: no monetary union works without a fiscal component. Avoid at all costs that the euro could have its own indebtedness capacity via a real asset without risk, a Eurobond – which essentially presupposes a properly sovereign federal instance with fiscal capacity. In turn of course the European Parliament in the limbo: “Representation without taxation”.

The institutional patching deployed along the crisis in the form of a string of acronyms that circumvents the essential problem is endless and the maximum expression of that reality. On all fronts: the ESM (European Stabilization Mechanism,) for bank and sovereign rescue is directed by governmental and non-EU criteria and is not sufficiently endowed. On the Banking Union front, there are bank supervision and rescue mechanisms (SSM) but its financing is also limited. The third leg, the European Deposit Insurance Scheme (EDIS), where risks would be shared, remains in the pipeline despite Draghi´s continuous claim for it to foster consolidation. The embryo of a possible European Treasury, the European Monetary Fund (EMF), in a late semantic pirouette, now taken to a minimalist version of an anti-cyclic instrument in favour of competitiveness and convergence (BICC), is undesigned and again ridiculously endowed. All this endless cackling is settled with a Eurobond. The lukewarmness of the institutional denunciation of this reality, the entire financial sector included, is unnerving.

On the bright side…, the appointed-to-be new Commission shows a much more integrationist profile than the outcoming one. Von der Leyen, president, in 2015 “leaked” the expression “United States of Europe”. Margarethe Vestager, the black beast of the big techs which have avoided taxes in Europe – and branded by Trump as “anti-American”, repeats in competition and also takes the new position in digital economy. Former Prime Minister Paolo Gentiloni takes the portfolio of Economic Affairs – who better than an Italian to explain in Italy what a responsible budget is? In industrial policy, defence and internal market, the French Sylvie Goulard to join a single front in defence and delineate a less fragmented and more regionalist industrial policy: Mergers where European interest at the global level requires it.

The composition of the European Parliament also looks inspiring … After the elections in May, a less bi-partisan but at the same time more centrist balance of power has come to the fore thanks to greens and liberals. It suggests a more vindictively federalist approach in its tensions with the Council. After all, for liberals, federalism is part of their foundational creed, socialists ought embrace solidarity more eagerly , and for the greens, it is an inextricable part of their modus operandi to aspire to the highest maximum global instance to make any sense of their political goals – effectively attacking externalities Internationally.

The question will be whether the president of the Commission, von der Leyen in that “Future of Europe” conference, will be able to distil the essence of what an EU integration pulse can aspire to. After the expansion weaknesses (very shallow rule of law compliance by some new members), and the multiple speed reality around concentric circles, have been exposed, the completion of Monetary Union around a Fiscal Union and the Eurobond, should emerge and portrayed as the critical impending goal. Only the force of gravity of this change can give consistency and direction to the rest. On the procedural side, moving from unanimity to qualified majority (QMV) to forge the federalist instance.

Under this above mentioned systemic and structural interpretation of the euro crisis, the achievements and merits of these last seven years must be brandished with the Northern electorate to open a new, healthy and responsible negotiating table that should redirect the Stability and Growth Pact to a new regulatory framework of discipline and convergence around the euro bond and the Fiscal Union – and be constitutionally enshrined by country members, as the SGP was.

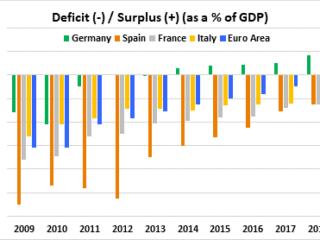

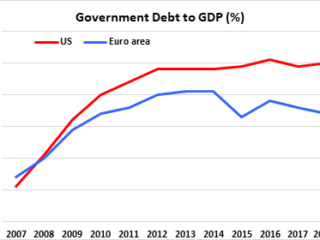

The returns of hard-won years of disciplines are evident and possibly enough to ignite a new narrative among northern creditors on how to continue the integration:

After 10 years of crisis in which the purely national criterion to guarantee the economic and financial health of the parties – Merkel, has been rightly exhausted (all eurozone countries in current account surplus) –, Macrons “Europe that protects”, with which the citizen could be identified, should be inspired from within doors in principles of solidarity, cohesion, and convergence (social democrats, liberals and greens). And beyond the borders, with realism, rigor of Law and all the entity and force that can come about for its sheer size – “real politic” (EPP): a typically right-wing stance morphed to a European level. It is probably the only physiognomy that the reformist integrationist impulse can present. The composition of the Parliament itself and the genesis of the appointment of senior officials (around a nuclear liberal / social-democratic / green force promoted by Macron than “rescuing” the EPP with von der Leyen), suggest so.

All roads lead to Eurobond

It is not plausible that Germany, which owns the final guarantor firm at the crystallization of this process, is not looking through the crack to the other side of this door. The aggregate macroeconomic indicators for the eurozone are stimulating at all points: public aggregate deficit of 1% versus 6% in the US, debt stock of 84% versus 105%, and surplus position of 2-3% in current account compared to a 6% deficit US. It turns out that together we are by far the global zone with the best macroeconomic table (- yes one has to lead), so that if the transit from an imperfect exchange arrangement to a real sovereign currency-endorsed with fiscal capacity and a Eurobond, is consummated, a new proposal is launched to the global financial market place, a new paradigm that purges the excesses of free societies in recent decades – a euro, closer to the gold standard and a fiduciary anchor to the international monetary system. Also, a spearhead for foreign policy action so that the green revolution can accelerate – in which country but Germany have greens become a mainstream party? Can there be more need for a German Europe in the world?

The recent news around the Bundestag and Scholz suggesting a fiscal impulse at a national level in case of a recession are already an advance against the hermetic position of “budget 0”. The question of how much there is to conclude that the fronts that demand more public investment: green economy, infrastructure, digitalization, defence and immigration, are precisely those that by nature require a more federalist approach, remains to be seen. Macron´s statements at the beginning of the year in the European press in favour of that “Europe that protects” and that connects with its citizenship came precisely to outline these fronts with the need to address them from federalism. Unquestionably, its pro-Europeanist position – after the initial grand standing speech at La Sorbonne, has become much more capillary and intelligent – “the pitch before funding”. Given the commitment and incipient success shown with his internal reformist agenda, we must expect much greater understanding around the key Continental axis.

The “geopolitical” and identitary importance of a Eurobond in these globalizing financial times, can’t be understated and has to be publicized. It is the automatic overhaul mechanism of the entire financial system (yield curves above, sustainability of banking business models, risk-free assets, etc.), the framework to re-arrange internally economic discipline and convergence, and the instance to refloat our abated capital markets – and as a corollary it should provide the narrative for an enthusiastic society with faith in the future. It is the definitive frontier on the irreversibility of the EU, and the legitimate title on the global stage to set standards, pursue interests and condition agendas. Frankly speaking, that the exhumation in the pyre of nationalism prevents us from exploring the monumental economies and policies of scale that this process of internal cauterization and external projection brings, is, over time, highly unlikely. A Europe for those who come.

If you want to give feedback to the article you can contact the author directly by .

You can fnd the German translation here.

The Spanish original version is to be found here: